Most importantly, remember that being granted an extension to file your business taxes does not grant you an extension to pay them, so plan on paying an estimated amount of tax when you file Form 7004 or Form 4868.Victims in FEMA Disaster Areas: Mail Your Request for an Extension of Time to File

HOW TO FILE EXTENSION FOR BUSINESS TAX RETURN PROFESSIONAL

You can either call your CPA, contact the IRS by phone (call volumes during tax season tend to be very high, so expect long hold times) or make an appointment to talk to a tax professional at your local Taxpayer Assistance Center. Still have questions about business tax extensions? You can apply for the extension using Form 2350. If you are a US citizen or resident alien who is living or running your business outside of the United States on the regular due date of your return, you may qualify for an automatic 2-month extension.

Special Note: Automatic 2-month extension

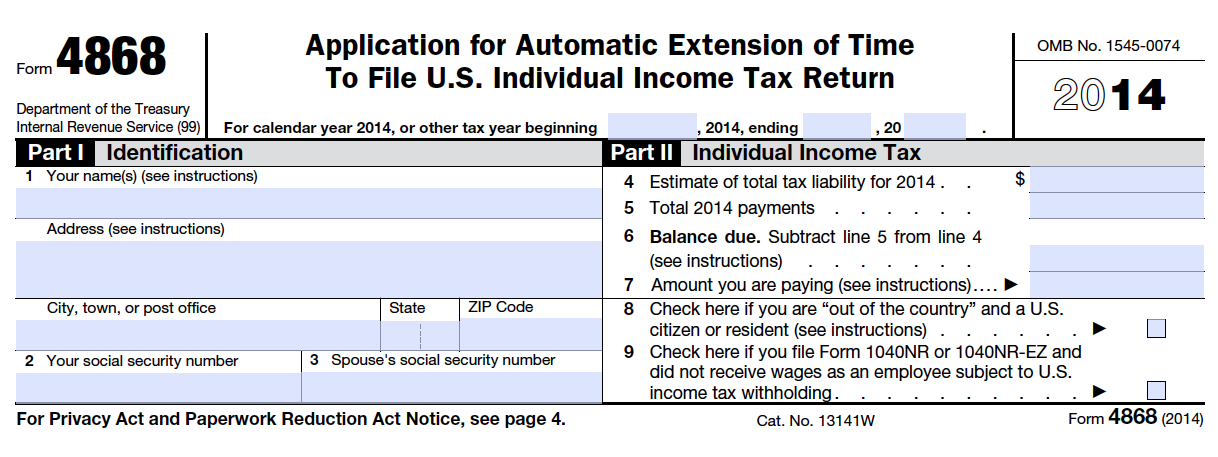

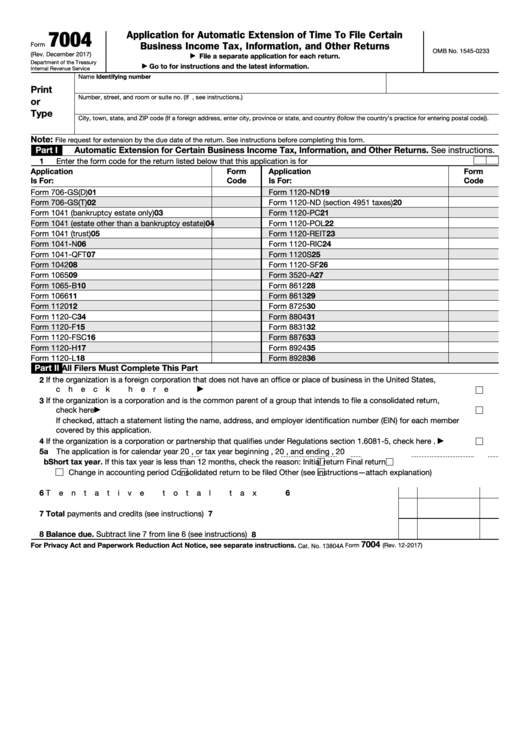

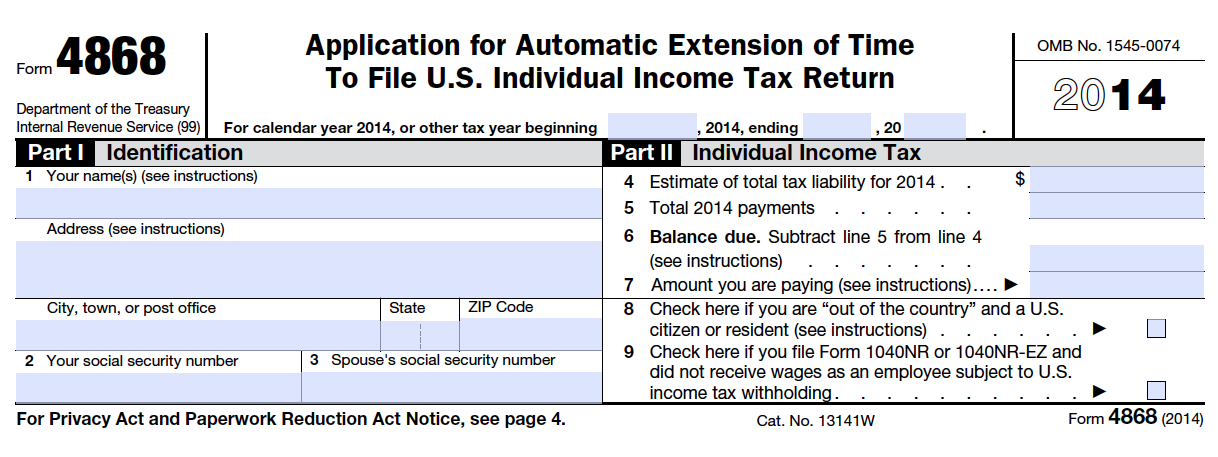

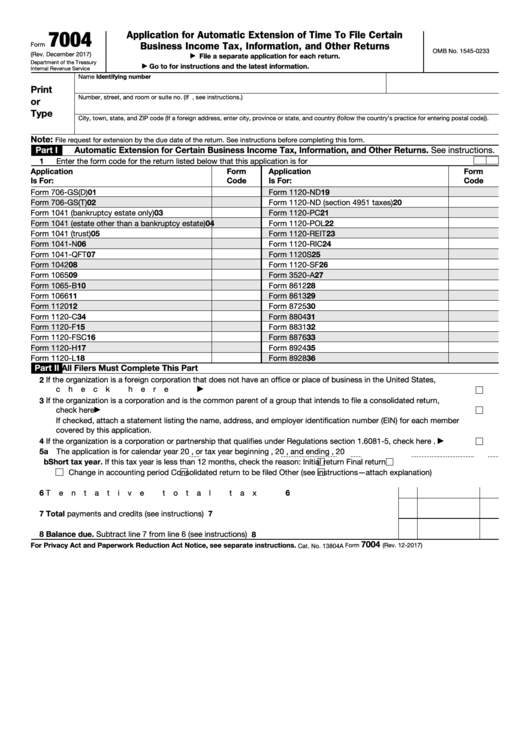

Type of business tax return you plan to file: ( Form 1065 is for partnerships, Form 1120-S is for S Corps, and Form 1120 is for C Corps). However, filing a tax extension requires little more than the following: Instructions for filing Form 7004, along with related information, can be found on the IRS website. Step 6: Review the instructions for filing That’s also the date your personal tax return will be due. That means partnerships and S Corps need to file completed business tax returns by September 15, 2020.įor C Corps, the tax return will be due October 15, 2020. Step 5: Take note of when your tax return is dueįorms 70 only get you a six-month extension. When you file electronically, you should receive instant confirmation that your extension has been granted. Step 4: File your extension application and paymentĮither you or your CPA can prepare and submit your application and payment to the IRS.Īlthough you can file for an extension by mail, consider filing electronically using the IRS’s e-File service. The due date for filing your tax extension can be different for different business entities. You’ll also be refunded any overpaid taxes when your tax return is filed.Īs always, check in with your CPA to get advice tailored to your business. That way you’ll avoid being charged interest and a late penalty for any additional taxes you haven’t paid. It’s always best to slightly overestimate the amount of taxes you need to pay. You’ll also have to deduct any payments or credits. When you file for a business tax extension, you’re required to estimate the taxes you owe for the 2019 tax year and submit this payment, along with your extension application, to the IRS. No, an extension won’t get you out of paying your business taxes. Step 2: Estimate your 2019 taxes owed Related The One Thing Your Employees Want More Than Money Team Management Not sure what type of business you have? Then check here. Sole proprietorship, or if you need to file an extension on your personal income tax: IRS Form 4868.  Partnership, LLC filing as a partnership, corporation (“C Corp”), or S corporation (“S Corp”): IRS Form 7004. Here are the forms you’ll need to file, depending on your business type. Still have questions about business tax extensions?.

Partnership, LLC filing as a partnership, corporation (“C Corp”), or S corporation (“S Corp”): IRS Form 7004. Here are the forms you’ll need to file, depending on your business type. Still have questions about business tax extensions?.

Special Note: Automatic 2-month extension.Step 6: Review the instructions for filing.Step 5: Take note of when your tax return is due.Step 4: File your extension application and payment.Step 3: Find your tax extension due date.

0 kommentar(er)

0 kommentar(er)